Savings and Credit Cooperative Organizations (SACCOs) have solidified their role as key financial institutions in Kenya, offering accessible credit, attractive savings options, and financial empowerment to millions.

In 2025, SACCOs continue to thrive, regulated by the Sacco Societies Regulatory Authority (SASRA), which ensures their financial stability and compliance with legal frameworks.

With Kenya’s economy constantly evolving, SACCOs remain crucial in providing affordable financial services to individuals and businesses that may not always have access to traditional banking institutions. This article provides a detailed look at licensed SACCOs in Kenya in 2025, their role in financial inclusion, and the numerous benefits of joining one.

Understanding SACCOs and Their Role in Kenya

SACCOs are member-owned financial cooperatives that provide savings and credit facilities. Unlike commercial banks, which primarily focus on profit-making, SACCOs exist to serve their members by offering affordable financial services and reinvesting profits into the cooperative for the benefit of all members.

They cater to a diverse range of members, from salaried employees and business owners to farmers and small-scale traders. Their structure allows individuals from different economic backgrounds to access credit and accumulate savings in a secure and regulated environment.

The Regulatory Framework: Licensed SACCOs in 2025

To ensure the safety of members’ funds and maintain financial discipline, SACCOs in Kenya operate under strict regulation by SASRA. The regulatory body is responsible for licensing SACCOs, monitoring their operations, and enforcing compliance with financial regulations.

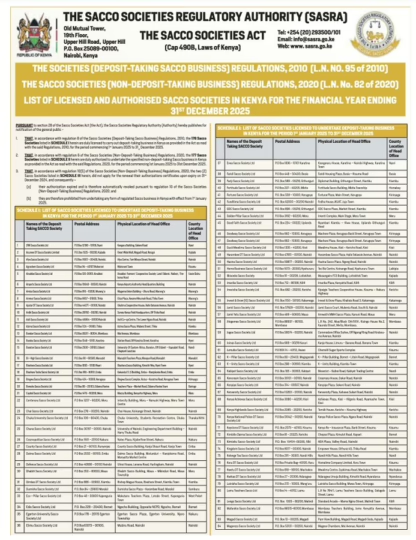

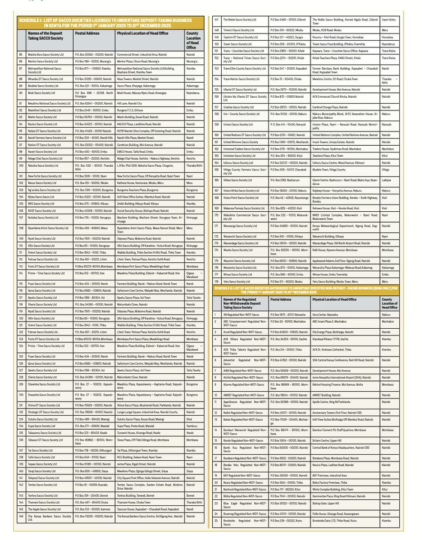

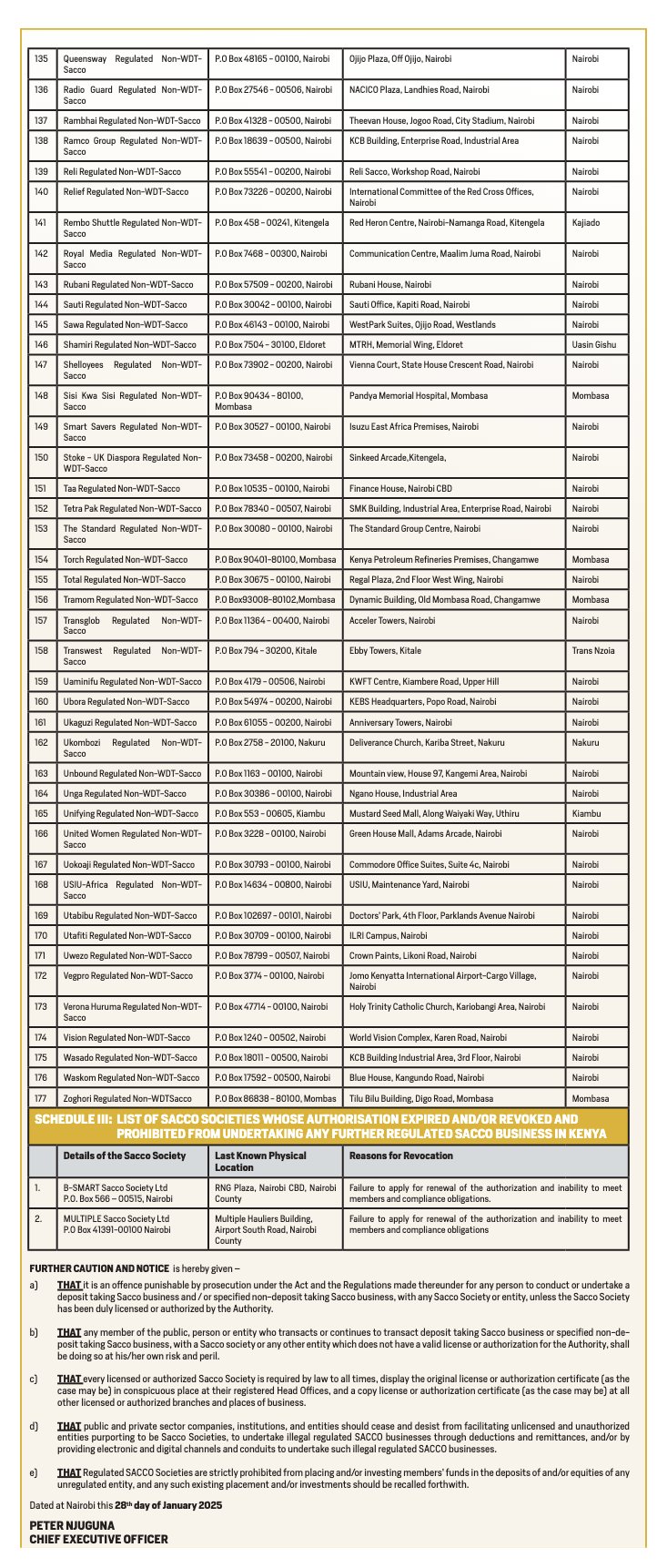

Each year, SASRA publishes a list of licensed deposit-taking SACCOs that have met the required financial and operational standards. As of 2025, there are:

- 178 licensed deposit-taking SACCOs, which can accept deposits from members and offer regulated financial products.

- Several authorized non-deposit-taking SACCOs, which primarily focus on loans and credit facilities.

- Some SACCOs with expired or revoked licenses, highlighting the importance of verifying a SACCO’s compliance before joining.

These regulations protect members from financial mismanagement, fraud, and insolvency while ensuring that SACCOs maintain proper governance and financial discipline.

Why Join a SACCO? Key Benefits for Members

1. Encouraging a Culture of Saving

SACCOs offer structured and disciplined savings programs that help members build financial security. Unlike regular savings accounts in commercial banks, SACCOs require members to contribute regularly, ensuring a habit of saving that leads to long-term financial growth.

Most SACCOs have mandatory monthly savings, which accumulate over time and allow members to access loans based on their savings record. The more a member saves, the more financial benefits they unlock, including higher borrowing limits and better interest rates.

2. Access to Affordable Credit and Loans

One of the biggest advantages of SACCOs is their affordable loan facilities, which often have lower interest rates than commercial banks. SACCO loans come with flexible repayment terms and fewer bureaucratic hurdles, making them accessible to many Kenyans who may not qualify for bank loans.

SACCOs offer various loan products, including:

- Development Loans – Long-term loans for investment in projects such as real estate, education, or business expansion.

- Emergency Loans – Quick access to funds for urgent needs, such as medical expenses or unexpected financial challenges.

- Asset Financing – Loans specifically for purchasing assets like cars, machinery, or agricultural equipment.

- Salary Advance Loans – Short-term loans available to salaried members to help them manage financial shortfalls before payday.

Unlike banks that often require collateral or extensive credit histories, SACCOs use member savings as security, making loans easier to access.

3. Higher Returns on Savings and Dividends

SACCO members enjoy higher interest rates on savings compared to traditional bank accounts. Additionally, members benefit from annual dividends, which are distributed based on their share contributions.

There are two main types of SACCO dividends:

- Interest on Deposits – Earned based on the amount of money a member has saved over the year.

- Share Capital Dividends – Earned by members who have invested in the SACCO’s shareholding.

Dividend rates can range from 10% to 15%, depending on the SACCO’s financial performance, making SACCOs a profitable savings avenue.

4. Financial Security and Stability

Unlike informal lending groups or chamas, SACCOs operate under strict financial regulations that ensure the safety of members’ funds. Licensed SACCOs must submit financial reports to SASRA, ensuring transparency and accountability.

Members can rest assured that their savings and loans are handled professionally, reducing the risk of financial loss due to mismanagement or fraud.

5. Financial Education and Business Growth Opportunities

Many SACCOs offer financial literacy programs to educate members on saving, investing, and debt management. These initiatives help members make informed financial decisions, leading to better wealth accumulation and financial independence.

Additionally, SACCOs provide support for business financing, helping entrepreneurs and small businesses grow by offering affordable loans and investment opportunities.

6. Community and Social Support

SACCOs foster a strong sense of community and mutual support among members. Many SACCOs offer:

- Benevolent Funds – Support for members during emergencies such as illness, bereavement, or natural disasters.

- Education Scholarships – Some SACCOs provide education funds or bursaries for members’ children.

- Retirement Savings Plans – Long-term savings plans to help members secure their financial future.

This cooperative spirit makes SACCOs more than just financial institutions—they serve as support systems that uplift communities and improve members’ lives.

How to Choose the Right SACCO in 2025

With hundreds of SACCOs operating in Kenya, choosing the right one is essential for maximizing financial benefits. Consider the following:

1. Verify Licensing with SASRA

Always ensure the SACCO is licensed and regulated by SASRA. This protects you from fraudulent or mismanaged organizations. SASRA publishes updated lists of licensed SACCOs on its website (www.sasra.go.ke).

2. Assess Financial Stability and Performance

Review the SACCO’s financial reports, dividend history, and membership growth to ensure it is financially sound and capable of delivering promised benefits.

3. Compare Loan and Savings Products

Different SACCOs offer different financial products. Choose one that aligns with your savings goals and borrowing needs.

4. Check Membership Requirements

Some SACCOs have eligibility criteria based on profession (e.g., teacher SACCOs, police SACCOs) or employer affiliations. Ensure you meet the membership requirements.

5. Consider Reputation and Customer Service

Seek feedback from existing members, read online reviews, and visit the SACCO to assess their customer service and reliability.

Here is the full list of the licensed SACCOs in 2025: